AANZPA Financial Statements 2022 (PDF)

Summary

This is a report on the financial activities of AANZPA Inc. for the 2022 financial year including income, expenditure, the 2022 annual surplus and current financial reserves. This summary is based on the un-audited accounts for the year ending 30 June 2022. The 2021 un-audited financial accounts are available from the AANZPA website.

The report also contains Information about:

- regional finances

- audit

- regulatory compliance

- the proposed 2023 Annual Budget

- a summary of AANZPA’s financial trends

- motions about financial management and banking

Financial Accounts

The financial year being reported on is 1st July 2021 – 30th June 2022. All figures quoted in this report are in NZD and exclusive of GST. The comments below should be read in conjunction with the AANZPA 2022 Financial Accounts.

Note: where applicable, 2021 figures are in brackets.

Highlights

- The 2022 surplus of $9,064 is more than double 2021’s ($4,132).

- Membership fee income was slightly up. Half of that increase is due to the biennial increase in fees.

- BoE income of $2150 ($591) was significantly higher due to an increased number of assessments.

- Most expense categories were similar or less than 2021 except for the Journal (the 2021 Journal was bigger and cost more to post).

- Capitation expenses of $3007 ($6931) were well down because we didn’t pay capitation where there was no regional committee and an extra amount was paid in 2021 when we discovered payments had been missed.

- There was no conference in 2022. Conference expenses shown ($508) are from a non-refundable deposit from the cancelled face-to-face Auckland conference.

Income

- Compared to the 2021 financial year overall income was down by just over $1800 or 4%.

- Income from membership fees was up by a small amount, $1699 or 4%, to $45,807 ($44,108)

- Income from Interest, $491 ($1,730) was well down owing to very low interest rates and the maturing date of some term deposits.

- There was no conference income due to the 2022 Auckland conference being postponed and then cancelled. The 2022 online conference made a small surplus of $4,782, however, because the conference happened after 30th June 2022, this surplus will show up in the 2023 accounts.

Expenses

- Web and Admin expenses were down by 13% at $9,644 ($10,930). This expense category is made up of expenses for hosting and maintaining our website and paying our administrator, Lynne Haveenar. Web and Admin is our biggest expense category at about a quarter of all expenses and consumes 21% of income from Members Fees. We expect expenses in this category will remain at this level for the foreseeable future.

- Executive expenses $5,852 ($7,826) were down by a third, this followed the fall in this expense category that occurred in 2021. This is because the Exec wasn’t able to meet in person and meeting expenses are a significant proportion of Executive expenses.

- BoE expenses, $2,952 ($4200) were also significantly down (34%) for similar reasons; there were no in-person meetings

- Capitation in 2022, $3007 ($6,931), was well down on the previous year because in 2021 some regions were paid a catch-up amount after payments were missed during the 2020 year. No capitation was paid to regions with no active committee.

- Accounting and Audit expenses, $1,159, were down by about a quarter on the previous year ($1,424) owing to adequate preparation by all involved in presenting our books to our accountants.

Surplus

- There was a surplus of $9,065 ($4,133), nearly $5000 more than the previous year’s. This surplus results from the above factors of reduced expenditure and steady income.

Financial Reserves

AANZPA has sufficient reserves to continue its operations for the foreseeable future.

Having a financial reserve of $156,706 ($147,642) places AANZPA in a good position to meet any unanticipated expenditure or drops in income.

Regional finances

There were no active AANZPA regions in ACT, NSW or WA during the 2022 financial year. There were financial reports and supporting documentation from all active regions; Northern, Central, Canterbury, Otago, Queensland and South Australia. All regional accounts were reviewed by myself as AANZPA Treasurer. Reporting was of a very high standard and systems are in place to make sure funds are accounted for. We commend all of the regional treasurers and committees for their work.

Annual audited accounts

AANZPA’s Constitution requires our annual audited accounts to be presented to the AANZPA AGM, however, no audit report has been received from our accountants. The 2022 accounts are therefore presented for acceptance by this meeting, subject to audit approval.

Regulatory compliance

AANZPA is incorporated under the Incorporated Societies Act 1908 in Aotearoa New Zealand and is registered as an Incorporated Society by the New Zealand Companies Office (NZCO). In Australia, AANZPA is registered as a charity by the Australian Charities and Not-for-Profits Commission (ACNC). Both the NZCO and the ACNC require us to provide annual returns. The completion of these returns is delegated by the Executive to the Treasurer.

All returns to the NZCO and the ACNC are now up-to-date.

- The 2022 ACNC return is due to be completed by the 31 January 2023 and will be made following the AGM

- The 2022 NZCO return is due in January 2023 and will be made following the 2023 AGM.

NZ Charities Amendment Bill proposed changes

A bill amending the Charities Act 2005 has been introduced to the NZ Parliament and the bill is likely to be passed into law in 2023. The review is likely to result in extra requirements for charities to remain qualified for registration, like the maintenance of charitable purposes, who is qualified to act as officers and the wording of rules document (constitution). The Executive is keeping abreast of these changes and any potential impact on AANZPA.

Requirement to audit

Last AGM we let you know we were proposing the removal of our requirement to audit from the constitution, this year we will move changes to the constitution that will bring this into effect. The following discussion about the removal of the requirement to audit was emailed to the AANZPA membership on 20 October 2022. No responses were received apart from one thanking us for ‘enlightening remarks on audit’.

In place of an annual audit, the AANZPA will adopt Community Capacity Accounting’s 6-Points Account Check.

Background

The current audit system isn’t working well for us and we want to have the flexibility to use an alternate system. We don’t have that flexibility now because we are required by the AANZPA Constitution to have an audit. The Executive proposes that AANZPA remove the requirement to audit from our Constitution.

There are several reasons for removing this requirement. They were outlined in the 2022 Treasurer’s report to the AGM and are summarised here:

- Smaller organisations like ours are not required by law to be audited or to have an accountant’s financial review by either the Aotearoa New Zealand Companies Office (NZCO) or by the Australian Charities and Not-for-Profits Commission (ACNC).

- Audits and reviews are expensive and time-consuming for AANZPA and it is becoming more and more difficult to find qualified auditors.

- The time spent on Audit by the Board of Examiners, the Conference Treasurer, the Treasurer and the Assistant Treasurer is excessive and would be better spent in other ways.

- Delays in the audit process are the main reason our audited accounts are regularly received too late to be presented at our AGM. Getting our annual financial accounts from our accountants is relatively quick, however, in most years an incomplete audit has contributed to the inability of the Treasurer to present audited accounts to the AGM.

- Very few changes are made to our accounts following the audit, showing that we are currently providing a ‘true and correct record’ of our finances.

- AANZPA’s financial accounts will continue to be presented annually at our AGM as has been our practice. This will not change.

- Our accountants, Community Capacity Accounting, have developed a checking process to replace the annual audit for organisations like ours that aren’t required by law to have an audit. It is called a 6-Points Account Check (6PAC).

The 2022 audit will be completed by Community Capacity Accounting. If the motion removing the requirement to audit from the Constitution is passed there will be no audit in 2023.

Motion

A motion proposing changes to the AANZPA Constitution about our requirement to audit will be put following the presentation of this report. The motion will include both the removal of the requirement to audit and the removal of reference to gender.

Budget 2023

Last year’s budget forecasted a loss of $15,790 for the year ending 30 June 2022, so we had that quite wrong given there was a surplus of over $9000! The 2022 budget was based on, amongst other things, the Executive, BoE and Ethics Committee all being able to meet face-to-face and those meetings didn’t happen. Therefore, meeting expenses for the Executive were down on budget by 87%, BoE by 80% and the Ethics Committee by 100%. It seems that, like other things in 2022, budgeting was difficult to achieve. Other budgeted funds weren’t expended until after the end of the financial year.

We are required by our Constitution to develop a budget and present it to the AGM each year. Below are our budget estimates for 2023. The draft budget for the year ending 30 June 2023 was approved by the Executive on 2 December 2022. We now present the 2023 Budget to the membership for your acceptance. There will be a motion at the end of this report to approve the budget.

| AANZPA Budget | ||

| For the year ended 30 June 2023 | ||

| Income | ||

| BoE Income | 2,000 | |

| Conference Income | 7,490 | |

| Interest | 2,160 | |

| Membership Fees | 45,680 | |

| Toatl Income | 57,330 | |

| Expenses | ||

| Accounting and audit | 1,500 | |

| BoE Expenses | 11,860 | |

| Conference Income | 2,202 | |

| Bank Fees | 500 | |

| Executive Meeting Expenses | 8,500 | |

| Insurance | 3,500 | |

| Office Expenses | 180 | |

| Project Grants | 10,247 | |

| Subscriptions, Workshops, Incorporation Fees | 1,500 | |

| Journal | 6,500 | |

| Koha | 4,500 | |

| Membership Secretary Administration | 7,200 | |

| PACFA | 6,203 | |

| Regions (capitation) | 2,600 | |

| Web | 4,080 | |

| Total Expenses | 71,072 | |

| Net Surplus (Deficit) | (13,742) | |

You will see we have again budgeted for a deficit, this year $13,742. There are three areas to highlight in the 2023 budget:

1. Travel for meetings

The Executive has decided to keep meeting in-person despite the considerable expense of these meetings. The Executive will meet twice in the budget period without the benefit of a conference to affray travel costs. Exec meetings involve travel from either Australia and Aotearoa, the cost of this travel is significant and not likely to reduce in the near future. These face-to-face meetings are vital to our success as a group and are considerably more productive than those carried out on Zoom. The same is true for Board of Examiner and Ethics Committee meetings. The Board has already met in 2022 and the Ethics committee are planning to meet after the end of the financial year.

2. Executive Project Grants

The Executive has granted $5000 to facilitate bi-cultural work in Aotearoa including holding a hui at a marae. We have included this budget with the existing Small Grants Fund under one heading, Exec Project Grants.

3. 2022 AANZPA Conference Auckland

The 2022 Auckland Conference has been included in the 2023 budget because the conference happened during the 2023 financial year. Without the small surplus from this conference our deficit will be even higher.

Trends

The Executive has asked for historical information so there is a better understanding of movements in our Accumulated Funds (Reserves) and trends in Income and Expenditure. This information will assist us to make plans for the future. We have included this financial trend information for your interest and comment.

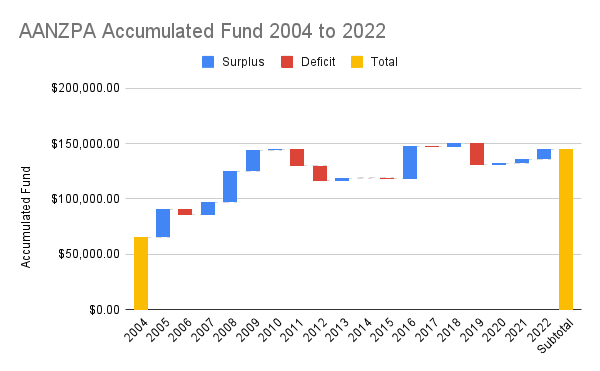

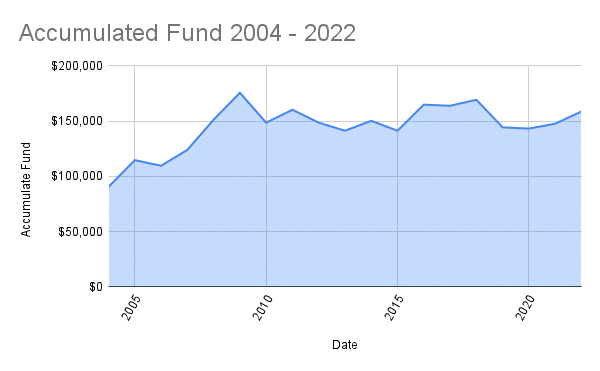

Accumulated Funds (Reserves) 2004 to 2022

Below are two charts showing AANZPA’s Accumulated funds 2004-2022. The first, ‘waterfall’, chart shows the relative contribution each year’s surplus and deficit made to the fund from $90,433 in 2004 to the current $158,745.

The second Accumulated Fund chart shows the steady increase in funds due to conference surpluses to a peak of $175,700 in 2010 followed by a fluctuating but reasonably steady state for the next 12 years.

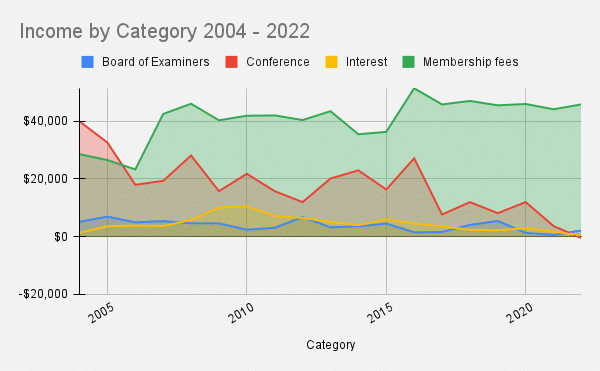

Income by Category 2004 to 2022

The Income by Category chart shows changing trends for sources of income. A steadily higher proportion of income is coming from membership fees and there is a general drop off of income from Conferences. Less income is sourced from Interest.

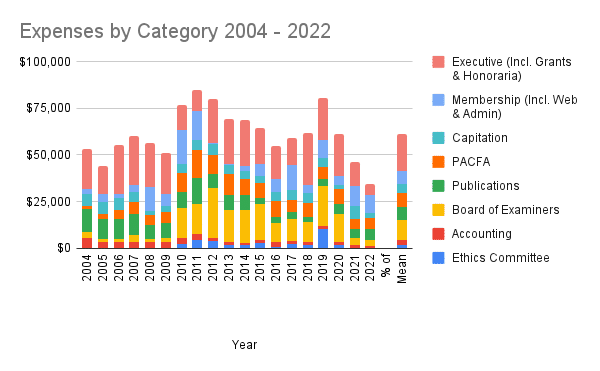

Expenses by Category 2004 to 2022

The Expenses by Category chart puts into perspective the significant drop in overall expenditure in both 2021 and 2022 that enabled us to achieve a surplus during a 2-year period when income remained steady.

Thanks

As Treasurer I manage AANZPA finances through the contributions of many people. In particular, I’d like to express my deep appreciation to Joan Hamilton-Roberts who is the Australian Assistant Treasurer. Our Assistant Treasurer manages the Australian bank accounts when the AANZPA Treasurer is from Aotearoa. Joan is generous, quick to respond and completely dependable. I really enjoy working with her. Thanks, Joan.

I’d also like to thank:

- Board of Examiners treasurers, Bev Hosking and now Cher Wiilscroft in Aotearoa and Rollo Browne in Australia

- Eric Park and David Grant, the Auckland Online Conference 2022 treasury team

- Lynne Havenaar, AANZPA’s Membership Administrator

- Regional treasurers and others who have kept regional finances in order, Marcel van der Weerden, Dianne Pepicelli, Cushla Clark and Anja Van Holten.

Motions

- Audited Annual Accounts

- That the financial accounts for the year June 30 2022, are accepted subject to audit approval.

- Budget 2023

- That the Budget for the year ending June 30 2023, is approved.

- Accounting 2023

- That Community Capacity Accounting is appointed as our accountant for the financial year ending June 30, 2023.

- ANZ Australia: Confirmation of signatories

- That Joan Muriel Hamilton-Roberts 01.11.1952 is confirmed as the signatory for the following bank accounts:

- 01 2950 2549368 02

- 01 3516 5288266 79

- 01 2204 1806923 81

- 01 3006 2601488 29

- 01 3440 9768320 28

- Signing rule to be ‘Anyone can sign by themselves’

- That Jennifer Elizabeth Hutt birthdate 12.09.1954 is added as a signatory for the following bank accounts:

- 01 2950 2549368 02

- 01 3516 5288266 79

- 01 2204 1806923 81

- 01 3006 2601488 29

- 01 3440 9768320 28

- Signing rule to be ‘Anyone can sign by themselves’

- That Christopher Victor Patty 07.11.1958 is confirmed as the signatory for the following bank accounts:

- 01 2204 1806923 81

- 01 3006 2601488 29

- Signing rule to be ‘Anyone can sign by themselves’

- Westpac NZ: Effective control

- That effective control of the organisation is vested in Treasurer, Simon Neville Gurnsey and President, Martin Thomas Putt

To be put separately

Motion to change Constitution

- That the AANZPA Constitution be changed to remove the requirement to audit and remove references to gender